Fannie Mae 3501 2001-2024 free printable template

Show details

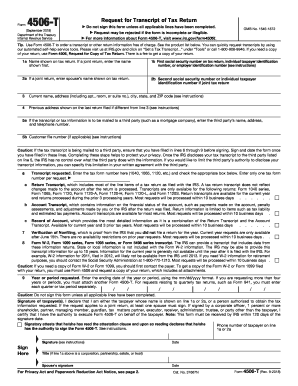

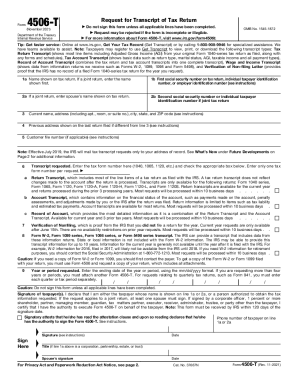

MULTISTATE ADJUSTABLE RATE NOTE-ARM 5-1--Single Family--Fannie Mae/Freddie Mac UNIFORM INSTRUMENT Form 3501 1/01 page 1 of 4 pages B The Index Beginning with the first Change Date my interest rate will be based on an Index. THIS NOTE LIMITS THE AMOUNT MY INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MAXIMUM RATE I MUST PAY. Date City State Property Address BORROWER S PROMISE TO PAY In return for a loan that I have received I promise to pay U.S. this amount is called Principal plus interest...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your sba form 3501 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba form 3501 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sba form 3501 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sba 3501 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out sba form 3501

How to Fill Out How to Make Note:

01

Start by determining the purpose or topic of your note. Decide what information or instructions you want to include.

02

Organize your note in a clear and logical manner. Use headings, subheadings, and bullet points to make it easier to read and understand.

03

Include relevant and important details in your note. Be concise and specific, providing step-by-step instructions or outlining key points.

04

Use clear and concise language. Avoid jargon or technical terms that may be difficult for others to understand.

05

Proofread your note for any errors or inconsistencies. Ensure that your note is easy to read and follow.

06

Consider the intended audience for your note. Tailor the level of detail and language used to suit their needs.

07

Save your note in a format that is easily accessible and shareable, such as a digital document or a physical copy.

08

Distribute or share the note with the appropriate individuals or groups who may benefit from the information provided.

Who Needs How to Make Note:

01

Students who want to keep track of important information or study notes.

02

Professionals who need to document procedures or guidelines for their work.

03

Teachers or trainers who want to provide instructions or information to their students or trainees.

04

Individuals who want to remember important details or steps for future reference.

05

Anyone who wants to communicate information or instructions clearly and effectively.

Fill fannie mae form adjustable rate : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file how to mae note?

Any individual or business entity that has an income over a certain amount is required to file income taxes. The amount of income required to file taxes varies by jurisdiction and filing status. Generally, individual taxpayers must file taxes if their gross income is greater than the standard deduction plus one personal exemption. Businesses must file taxes if their gross income is greater than their deductions.

How to fill out how to mae note?

1. Date: Enter the date of the note.

2. To: Enter the name of the person or group the note is addressed to.

3. From: Enter your name as the author of the note.

4. Subject: Enter a brief description of the contents of the note.

5. Body: Enter the body of the note. Provide details on why you are writing the note, what you need from the recipient, or any other relevant information.

6. Closing: End the note with a polite closing. Examples include “Thank you,” “Sincerely,” or “Best regards.”

7. Signature: Sign the note with your name.

What is the purpose of how to mae note?

The purpose of making notes is to record information quickly and efficiently. Making notes helps you to remember facts, ideas, and thoughts, and to organize them into a meaningful structure. Notes can also be used to support your argument or point of view in a paper or presentation.

What information must be reported on how to mae note?

When making a note, it is important to include the following information:

1. Who wrote the note and when

2. The purpose of the note

3. Any relevant details or context that might be needed in order to make sense of the note

4. Any action items or tasks that need to be completed as a result of the note

5. Any important deadlines associated with the note

6. Any relevant resources or references that might be helpful in understanding the note

When is the deadline to file how to mae note in 2023?

The deadline to file taxes in 2023 will depend on the individual's filing status and whether they are required to file. Generally, the deadline for filing taxes in the United States is April 15th of each year.

What is the penalty for the late filing of how to mae note?

The penalty for the late filing of a note varies depending on the type of note and the jurisdiction in which it was filed. Generally, the penalties for late filing may include fines, interest, and other legal costs. It is important to check with the relevant legal authorities in the jurisdiction in which the note was filed for any specific penalties that may apply.

What is how to mae note?

To make a note, you can follow these simple steps:

1. Start with a heading: Write the title or topic of the note at the top of the page to clearly identify its content.

2. Date and time: Add the date and time of the note to track when it was written. This is especially helpful for future reference or when reviewing previous notes.

3. Be concise: Keep your note short and to the point. Use bullet points or numbered lists to organize information and make it easier to read.

4. Use abbreviations or symbols: If appropriate, use shorthand or abbreviations to quickly jot down important points. For example, "w/ = with," "vs = versus," or "& = and."

5. Capture key details: Write down the essential information, details, or ideas you want to remember. Focus on the main points rather than trying to transcribe everything word-for-word.

6. Highlight important information: Use a highlighter or bold text to emphasize critical details or things that require extra attention. This helps you quickly locate important information when reviewing your notes later.

7. Add personal observations or questions: If something isn't clear or you have additional insights, feel free to include those notes. This can help you build upon the concepts or prompt further research or discussion later.

8. Review and revise: After taking the initial notes, take a moment to review and revise them if required. Organize the content in a logical order, make any necessary additions or corrections, and ensure it makes sense to you.

Remember, the purpose of note-taking is to capture important information quickly and effectively. Find a style and method that works best for you, and be consistent to make future reference simpler.

How can I edit sba form 3501 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your sba 3501 form into a dynamic fillable form that you can manage and eSign from anywhere.

Where do I find how to mae note?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the form 3501. Open it immediately and start altering it with sophisticated capabilities.

How do I execute adjustable note form online?

Easy online sba form 3501 pdf completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Fill out your sba form 3501 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Mae Note is not the form you're looking for?Search for another form here.

Keywords relevant to form adjustable rate note

Related to 3501 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.